The promotional products industry, a vibrant and dynamic sector, has shown remarkable resilience and adaptability in the face of global economic shifts and internal operational challenges. The ‘State of Growth 2023′ distributor benchmarking report by PPAI Media, combined with a series of inquiries into industry suppliers, offers a multi-faceted view of this industry’s progress and challenges. Let’s delve deeper into these findings’ trends, insights, and implications.

Technology: A Catalyst for Efficiency and Growth

The role of technology in the industry’s evolution cannot be overstated. From e-commerce technologies to advanced analytics for market insights, technology has been a game-changer. It has enabled companies to streamline operations, enhance customer experiences, and make data-driven decisions.

Smaller companies have leveraged technology to level the playing field, offering services and products that compete with larger entities. Larger companies, meanwhile, have used technology to scale their operations, reach new markets, and improve operational efficiencies.

Growth Trajectories and Market Dynamics

Despite the pandemic’s impact, the industry has steadily risen, particularly among smaller distributors and suppliers. Smaller distributors, often with revenues under $2.5 million, have displayed impressive agility and responsiveness to market changes. This segment’s growth is not just a rebound but a testament to its ability to foster strong customer relationships and adapt to new market realities.

Larger suppliers, on the other hand, have capitalized on their broad market reach and operational capacities to expand their client base significantly. The average number of distributor clients for large suppliers, standing at 34,967, indicates a vast market and a diverse array of opportunities for partnerships and business growth.

Operational Efficiencies: A Critical Factor

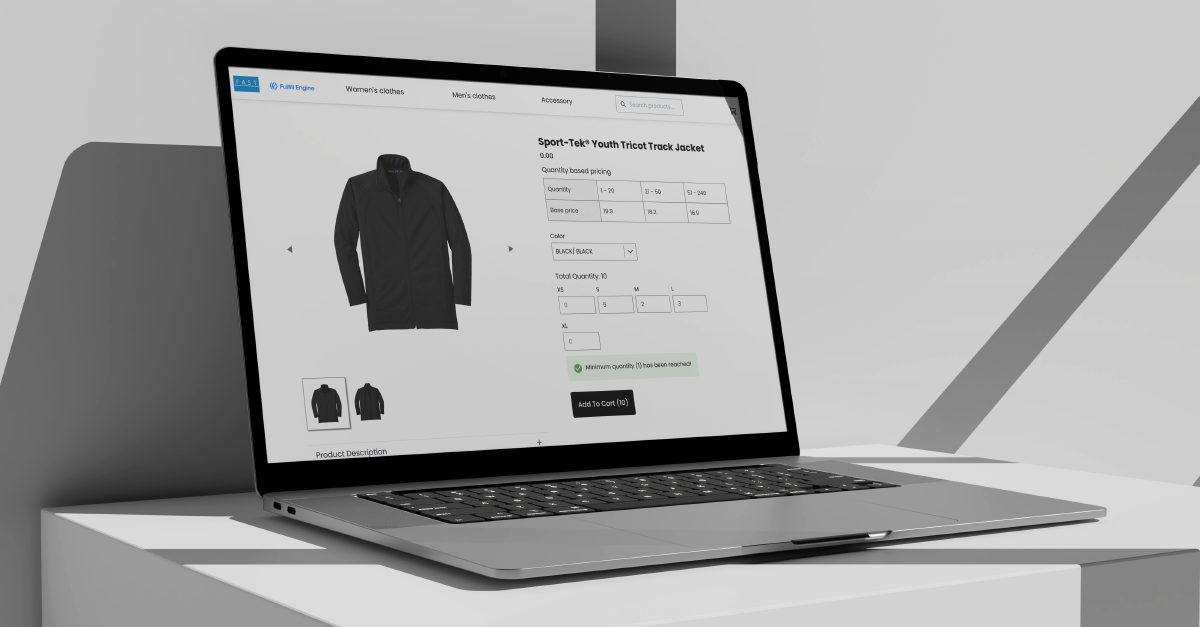

Operational efficiencies have emerged as a pivotal factor influencing profit margins across the industry. Suppliers and distributors alike have recognized the need to streamline processes, optimize resource allocation, and leverage technology to maintain competitive edges. For instance, the reliance on digital platforms and e-commerce has substantially reduced overheads and allowed even smaller players to compete on a larger scale.

In contrast, the challenges faced by smaller suppliers in generating profits from small order sizes and the complexities of on-time shipping underscore the need for continued innovation and efficiency improvements. This is where investment in technology, from automated order processing systems to customer relationship management (CRM) tools, plays a crucial role.

The Human Element: Staffing and Turnover

The industry’s human resource aspect, particularly concerning staffing and turnover rates, has been a topic of much discussion. Smaller companies, with their lean staffing models, often find their employees wearing multiple hats – from sales to customer service. This multitasking, while beneficial in terms of cost savings, can lead to higher turnover rates, especially in factory positions where economic conditions heavily influence job stability.

Larger suppliers and distributors, with more resources, are better positioned to offer competitive salaries, benefits, and a conducive working environment, leading to lower turnover rates. However, this doesn’t negate the challenges they face in recruiting and retaining skilled personnel, especially in a market where the demand for talent often outstrips supply.

Client Relationships: The Core of Growth

A key takeaway from the industry analysis is the importance of client relationships. For smaller distributors and suppliers, the depth of these relationships often compensates for the limited client base. These companies tend to have a more personalized approach, which allows them to understand and meet their client’s unique needs effectively.

Larger entities with a broader client base focus on balancing personalization and scalability. Their growth hinges on their ability to offer various products and services, cater to diverse client needs, and maintain high customer service standards.

Market Trends: Adapting to Change

The promotional products industry is not immune to broader market trends. The rise of sustainable and eco-friendly products, the shift towards digital marketing, and the increasing demand for customized and unique promotional items have all influenced how both suppliers and distributors operate.

Companies that have been quick to adapt to these trends, whether by expanding their product lines to include sustainable options or by leveraging digital marketing strategies to reach a wider audience, have seen significant growth. This adaptability is crucial in an industry that thrives on innovation and creativity.

Financial Acumen: Navigating Economic Uncertainties

Financial management has emerged as a crucial skill for both suppliers and distributors. Smaller entities, in particular, have demonstrated a keen understanding of financial stewardship, ensuring quick payment capabilities and judicious management of resources. This financial prudence is essential, especially when navigating periods of economic uncertainty.

Larger companies with more complex financial structures have focused on maintaining profitability while investing in growth and expansion. Their ability to manage finances effectively, from cash flow management to strategic investments, has been a key factor in their sustained growth.

Looking Ahead: Future Prospects and Strategies

As the industry moves forward, several strategies will be key to continued growth and success:

Companies must continue to innovate, offering products and services that meet evolving market demands and customer preferences.

Enhancing the customer experience, from the ordering process to after-sales service, will be crucial in retaining and expanding the client base. Learn more.

Continued investment in technology will be essential for operational efficiency and market competitiveness.

Attracting and retaining skilled personnel will be critical, especially as the industry faces talent shortages in various roles.

The ability to quickly adapt to market changes, whether economic fluctuations or evolving customer preferences, will determine long-term success.

The promotional products industry stands at a pivotal juncture. The insights gleaned from the ‘State of Growth 2023’ report and supplier inquiries offer a roadmap for navigating the complexities of this dynamic industry. By focusing on operational efficiencies, client relationships, technological advancements, and talent management, companies across the spectrum can harness growth opportunities and solidify their positions in the market.